To be honest, designing business marketing campaigns for existing customers is as difficult as nailing jelly to a tree. That’s

Big Data

Why a Customer-Centric Business is the role model for all 21st – century organizations

03

Jan

With the world rapidly evolving, customers have become almost equivalent to business owners dictating the shopping terms, sales funnel, marketing

13 Predictive Models that are tagged as game-changer for business

30

Dec

PREDICTIVE MODELS 2020 Be more accurate towards forecasting your data. Know the hidden patterns within your data to explain statistical

Is Data Analytics and AI the future of hassle-free Banking services?

14

Nov

In an era of machines and Artificial Intelligence, the traditional form of banking has taken the back seat, when compared

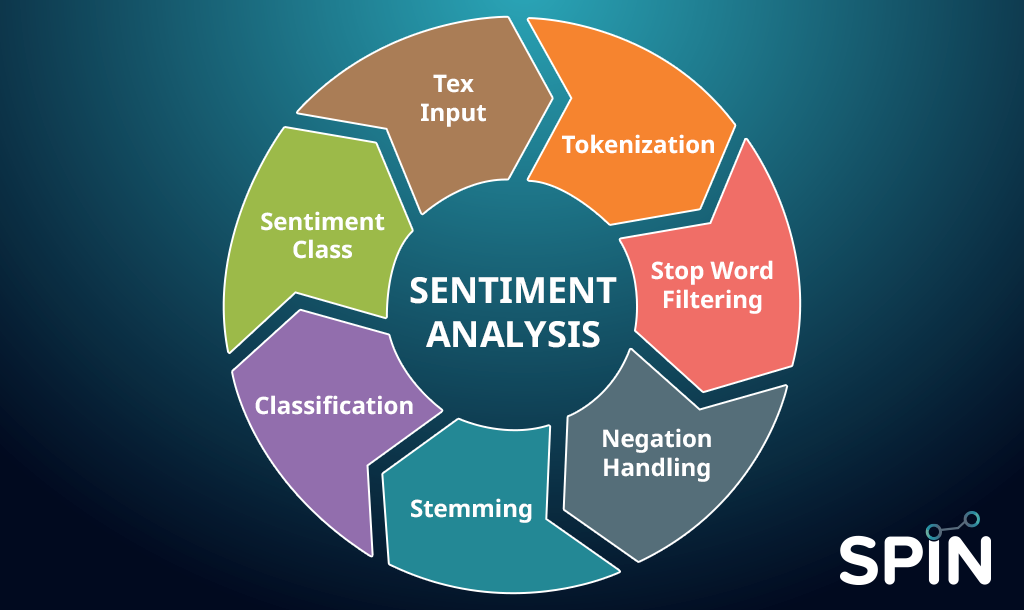

Why Sentiment Analysis is the major game changer for patient care

02

Nov

In a competitive era, when every industry is trying to reach the pinnacle of success, the healthcare industry too is